This central London location underscores our commitment to accessibility and transparency. You are always welcome to visit our office or get in touch with us via phone or email for any inquiries or assistance you may require.

Explore More

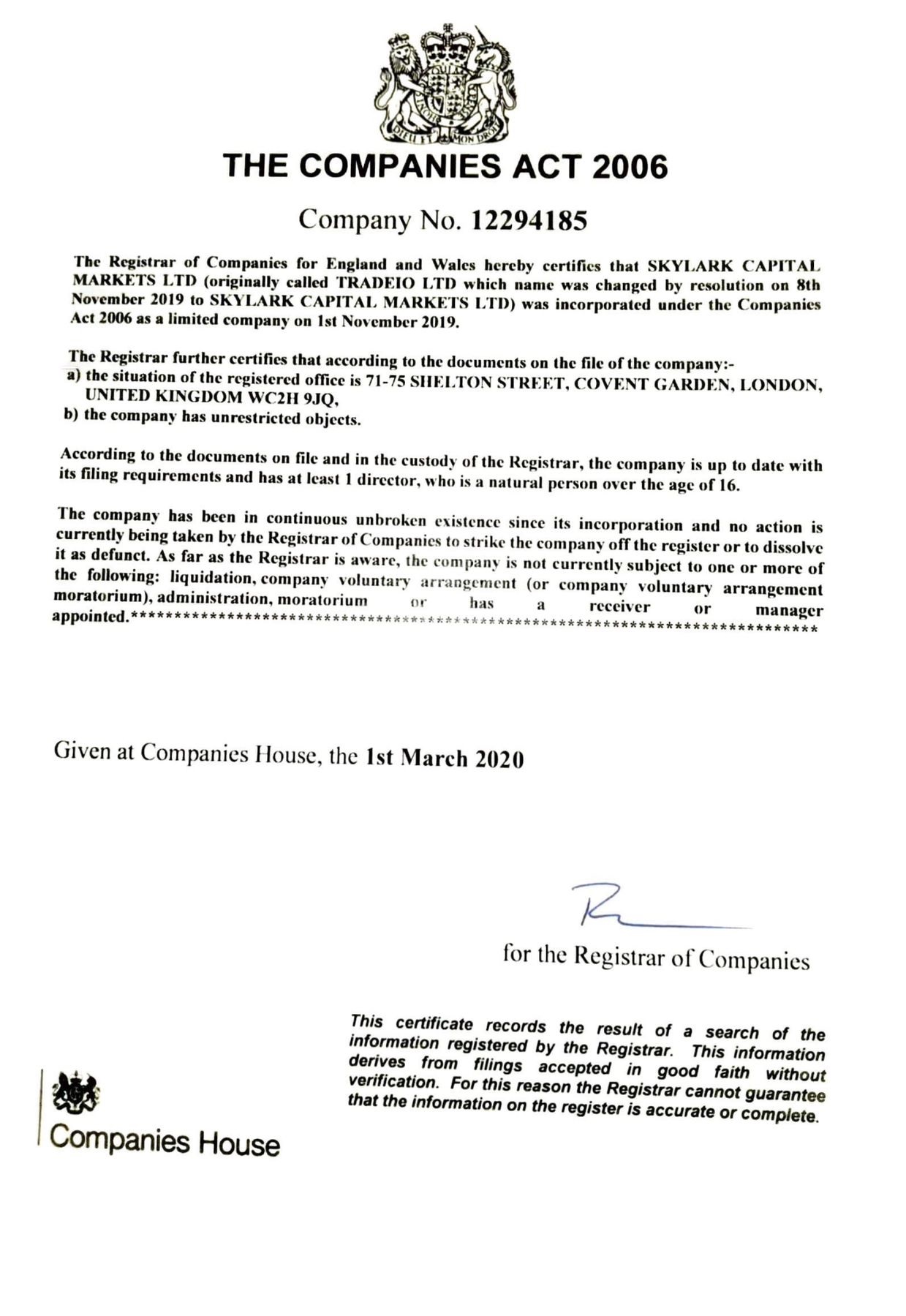

Welcome to Skylark Capital Markets Ltd, your premier destination for online trading in forex, commodities, and a wide range of financial instruments. As a private limited company with company number 12294185, we take pride in offering a secure and efficient platform to empower traders and investors to achieve their financial goals.

At Skylark Capital Markets Ltd, we understand the importance of transparency, trust, and compliance in the financial industry. We are committed to upholding the highest legal and ethical standards to provide you with a safe and reliable trading environment.

Registered Office Address

Our registered office is conveniently located at:

71-75 Shelton Street,

Covent Garden,

London, WC2H 9JQ.

Advanced Trading Technology: Our state-of-the-art trading platform is designed to meet the needs of both beginners and experienced traders. With real-time data, advanced charting tools, and lightning-fast execution, you can make informed decisions and seize trading opportunities.

Diverse Asset Selection: Skylark Capital Markets Ltd offers a wide range of financial instruments, including forex, commodities, indices, and more. You have the freedom to diversify your portfolio and explore various trading strategies.

Educational Resources: We believe in empowering our clients with knowledge. That's why we offer a comprehensive range of educational resources, including webinars, tutorials, and market analysis, to help you become a more confident and informed trader.

Customer Support: Our dedicated support team is available to assist you with any questions or concerns you may have. We are committed to providing prompt and reliable customer service to ensure your trading experience is smooth and hassle-free..

Security: We employ robust security measures to safeguard your funds and personal information. Skylark Capital Markets Ltd takes cybersecurity seriously, so you can trade with peace of mind.

Getting Started with Skylark Capital Markets Ltd:

Registering with Skylark Capital Markets Ltd is a straightforward process. Simply visit our website and follow the easy steps to create your trading account. Once registered, you'll have access to our trading platform, where you can start trading forex, commodities, and other financial instruments.

Whether you are an individual investor or a professional trader, Skylark Capital Markets Ltd is here to support your financial journey. Join us today and experience the world of online trading with a trusted partner.

The Central Bank of Curaçao and Sint Maarten (CBCS) is the central bank of the countries of Curaçao and Sint Maarten. It is responsible for maintaining monetary stability, promoting financial stability, and providing oversight of the financial sector within these countries. The CBCS plays a critical role in the economic and financial management of both Curaçao and Sint Maarten.

Monetary Policy: The CBCS formulates and implements monetary policy to control inflation and stabilize the currency within its jurisdiction. It manages the money supply and interest rates to achieve these objectives.

Currency Issuance: The CBCS is responsible for issuing and regulating the currency used in Curaçao and Sint Maarten. This includes the issuance of banknotes and coins.

Financial Stability: The central bank works to maintain the stability of the financial system. It supervises and regulates financial institutions such as banks, insurance companies, and other entities to ensure their soundness and adherence to regulatory standards.

Economic Analysis and Research: The CBCS conducts economic research and analysis to monitor economic trends, provide insights into the local and global economic environment, and inform policy decisions.

The term "Financial Services Commission (FSC)" is used to refer to regulatory authorities in various countries that oversee and regulate financial services and activities within their respective jurisdictions. These commissions are typically established to ensure the integrity, stability, and transparency of financial markets, protect consumers, and promote fair competition. The specific functions, responsibilities, and structure of an FSC can vary depending on the country.

Regulatory Oversight: FSCs regulate financial institutions and activities, including banks, insurance companies, securities firms, investment funds, and more. They set regulatory standards and guidelines to ensure compliance with laws and regulations.

Licensing and Registration: FSCs often grant licenses and registrations to financial institutions and professionals operating within their jurisdiction. They assess the eligibility and fitness of applicants before granting approvals.

Market Surveillance: FSCs monitor financial markets for any irregularities, fraud, or manipulation. They take actions to maintain market integrity and investor confidence.

Consumer Protection: Protecting consumers' interests is a key role of FSCs. They may establish rules and regulations to ensure that financial products and services are fair, transparent, and appropriate for consumers.